Section 179 And Bonus Depreciation 2024

Section 179 And Bonus Depreciation 2024. With section 179, you can deduct a certain dollar amount from your qualifying equipment acquisitions (purchased, financed, or leased) in 2024. Under the 2024 version of section 179, businesses cannot deduct more than $1,220,000 in assets.

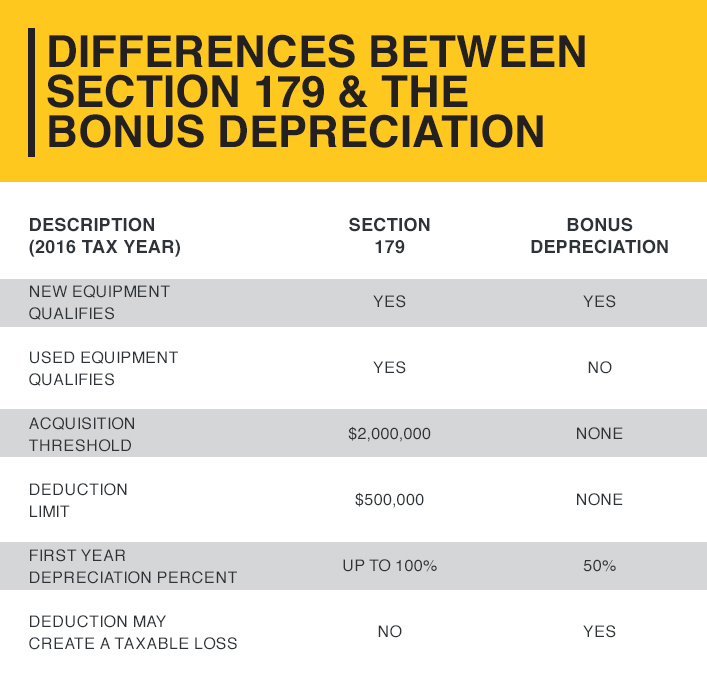

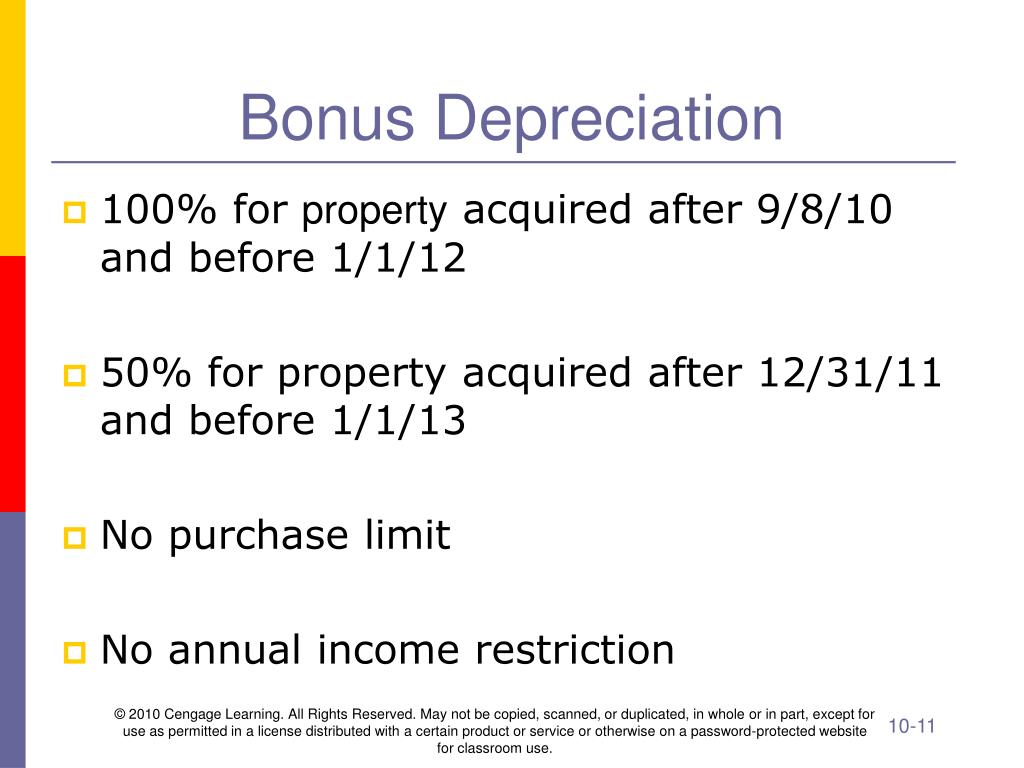

Businesses can leverage both bonus depreciation and section 179 in the same tax year to maximize their tax savings. While bonus depreciation and section 179 are both immediate expense deductions, bonus depreciation allows taxpayers to deduct a percentage of an asset’s cost upfront.

Section 179 And Bonus Depreciation 2024 Images References :

Source: www.clevelandbrothers.com

Source: www.clevelandbrothers.com

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, Learn about depreciation schedules and strategic tax planning with insights from.

Source: mandibterrie.pages.dev

Source: mandibterrie.pages.dev

Section 179 And Bonus Depreciation 2024 Mabel Rosanna, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168(k).

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

Section 179 And Bonus Depreciation 2024 Lenka Imogene, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: ionasophronia.pages.dev

Source: ionasophronia.pages.dev

Section 179 Bonus Depreciation 2024 Celine Corrinne, The 2024 section 179 deduction and bonus depreciation offer powerful incentives to invest in the equipment your business needs to thrive.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

Bonus Depreciation Limits 2024 Dita Donella, With section 179, you can deduct a certain dollar amount from your qualifying equipment acquisitions (purchased, financed, or leased) in 2024.

Source: mandibterrie.pages.dev

Source: mandibterrie.pages.dev

Section 179 And Bonus Depreciation 2024 Mabel Rosanna, Under the 2024 version of section 179, the deduction.

Source: elenaatlanta.pages.dev

Source: elenaatlanta.pages.dev

Irs Section 179 Bonus Depreciation 2024 Ida Lucille, It begins to be phased out if 2024 qualified asset additions.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), For 2024, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2023).

Source: edabcharmane.pages.dev

Source: edabcharmane.pages.dev

Section 179 Bonus Depreciation 2024 For Home Genia Jordain, 1 in 2024, bonus depreciation is 60% for.

Source: www.unitedevv.com

Source: www.unitedevv.com

Section 179 and Bonus Depreciation at a Glance United Leasing & Finance, It begins to be phased out if 2024 qualified asset additions.

Posted in 2024